Table of Contents

TogglePayroll services in Turkey is a vital part of business operations, especially for companies employing local or foreign staff. This guide provides a detailed overview of payroll regulations, taxation, social security, and essential procedures to help your business stay compliant and efficient.

Key Aspects of Payroll in Turkey

1. Employee Classification

Employees in Turkey are classified as full-time, part-time, or temporary. Each category has its own rules for working hours, compensation, and benefits.

2. Minimum Wage

As of 2025, the gross monthly minimum wage is TRY 26.005,50. All full-time employees must be paid at or above this level.

3. Taxation in Payroll

Payroll taxes include progressive income tax (15%–40%), and stamp tax (0.759% of gross wage). Minimum wage earners are generally exempt.

4. Social Security Contributions

Social security is managed by SGK. Employers contribute around 22.75% and employees 15% of gross salary.

5. Social Security Reductions

Employers with no premium debts and those sending workers abroad may receive a 5% reduction in contributions.

6. Tax Exemptions & Reductions

Exemptions apply to minimum wage earners and disabled employees. Some allowances may be partially or fully exempt from income and social security taxes.

Payroll Services in Turkey

1. Payroll Processing

Payroll is processed monthly and includes gross-net calculation, tax and SSI deductions, and reporting to tax office and SSI.

2. Payroll Parameters

Gross salary includes all earnings before deductions. Net salary is calculated by subtracting income tax, SSI, and other withholdings from gross salary.

3. Leaves

Annual, sick, maternity, and public holiday leaves are governed by Turkish labor law. Duration depends on years of service.

4. Compensations

Termination pay includes notice and severance pay. Notice period ranges from 2 to 8 weeks; severance pay equals one month’s salary per year of service.

5. Foreign Employees

Foreign workers must have a work permit. If staying more than 6 months, they are tax residents. Payroll applies similarly with attention to tax residency.

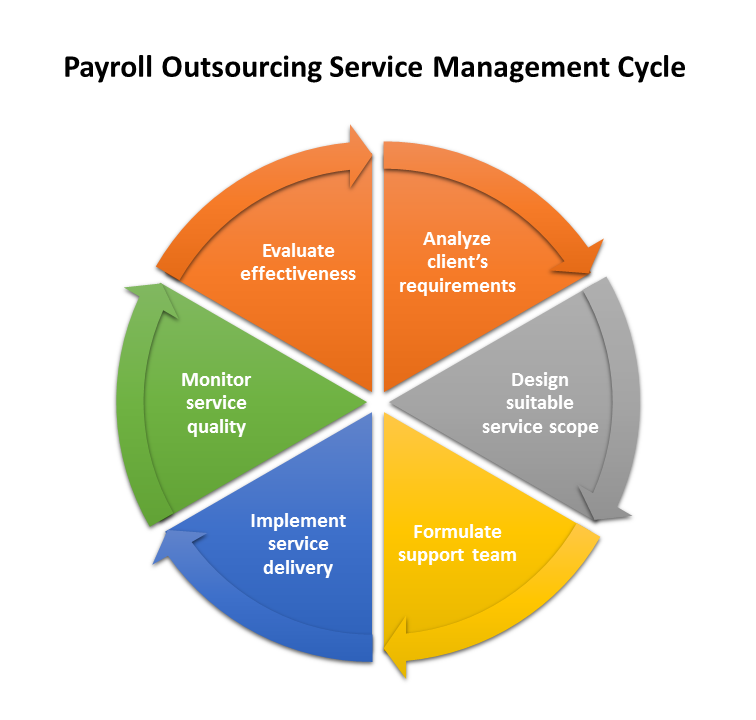

Outsourcing Your Payroll

Outsourcing your payroll in Turkey with OzbekCPA helps you minimize risk, ensure full legal compliance, and focus on your core business. We offer comprehensive payroll solutions tailored to your needs — from registration to termination, from calculations to reporting.

At OzbekCPA, we provide a comprehensive range of payroll services tailored to your company’s specific needs. Our experienced team ensures compliance with Turkey’s legal regulations, allowing businesses to stay focused on growth while we manage all payroll-related tasks.

Why Outsource Your Payroll?

Outsourcing payroll offers several benefits:

- Cost Savings: Reduces the need for an extensive internal payroll department.

- Data Security: Keeps sensitive payroll data secure through third-party confidentiality agreements.

- Efficiency: Increases accuracy and reduces the risk of errors.

- Legal Compliance: Ensures compliance with local labor and tax regulations

Core Payroll Services We Offer

Our payroll services include a wide range of tasks to ensure seamless payroll management for your company:

Registration and Termination

- Registration and deregistration with the Social Security Institution (SGK)

- Payroll setup for foreign employees, including work permit compliance

- Preparation of termination documentation, including severance and notice pay

Payroll Calculation and Management

- Complete gross-to-net payroll calculation

- Overtime, bonuses, and benefit allowances (meal, transport)

- Private pension (BES) and health insurance contribution tracking

- Minimum Living Allowance (AGI) calculation and inclusion

Monthly Reporting and Submissions

- Monthly SGK declarations and other mandatory filings

- Income tax and stamp tax calculations

- Bank payment list preparation

- Payroll slip distribution via email

Personnel and Labor Consultancy

- Monitoring of advances, garnishments, and leave status

- Workplace consultancy on employment matters

- Labor law advisory and legal documentation support

- Sick leave and workplace accident reporting

- Notifications to İŞKUR (Turkish Employment Agency)

- Reporting for TURKSTAT (Turkish Statistical Institute)

Compliance and Efficiency

Ensure Compliance and Efficiency with OzbekCPA

Partnering with OzbekCPA ensures that all your payroll operations are handled professionally and in full accordance with Turkish labor legislation. Our experienced team helps you avoid legal pitfalls, reduce costs, and improve administrative efficiency.

Contact us to learn how we can support your payroll needs in Turkey.