Table of Contents

ToggleWhy Establish a Company in Turkey?

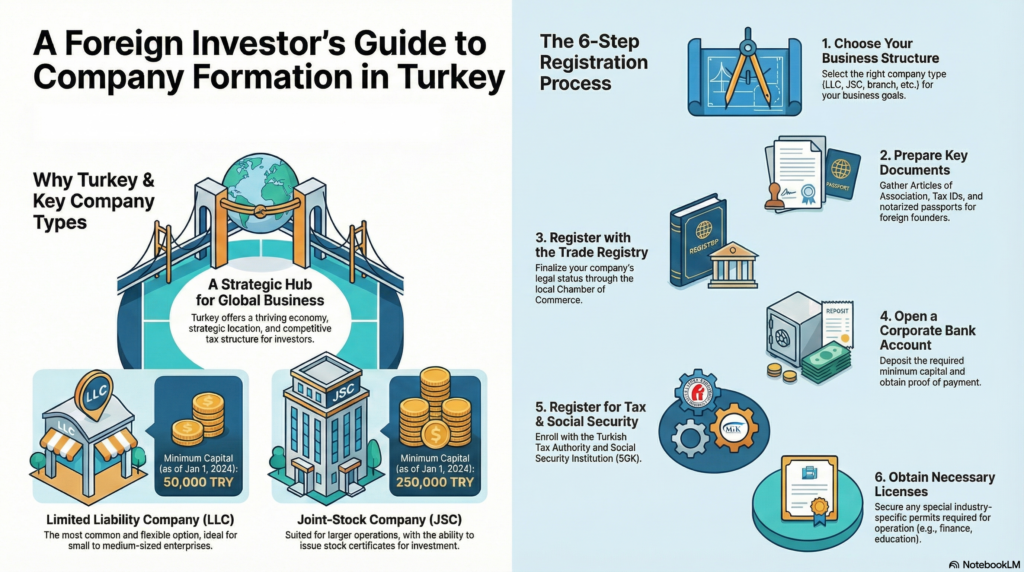

- Thriving Economy – Turkey is one of the world’s largest emerging markets, offering diverse investment opportunities.

- Strategic Location – Positioned at the crossroads of Europe, Asia, and the Middle East, making it an ideal trade hub.

- Business-Friendly Regulations – Recent reforms have simplified the company formation process, reducing bureaucratic obstacles.

- Competitive Tax Structure – Various incentives, tax exemptions, and free trade zones offer cost-saving opportunities.

- Access to International Markets – Turkey has free trade agreements with multiple countries and is a key partner in the EU Customs Union.

Company Formation with Ozbek CPA

As Ozbek CPA, we provide company formation and accounting and tax advisory services in Turkey. Since 2002, we have been leading the Turkish market with our experience and experienced staff. Contact us to develop customized solutions for you and identify your needs.

Types of Companies in Turkey

According to the Turkish Commercial Code (TCC), foreign investors can establish various types of companies, including:

Limited Liability Company (LLC) in Turkey

Starting an LLC in Turkey is one of the most common and practical methods for both local and foreign investors to register a company. For those comparing LLC vs JSC in Turkey, the LLC offers simplicity and flexibility for business setup in Turkey. To incorporate an LLC in Turkey, only one shareholder and a minimum capital of 50,000 TL are required. The shareholder can be an individual or a legal entity, and foreign founders are permitted to establish the company.

LLC company formation is ideal for those seeking a flexible business structure. Compared to establishing a joint stock company in Turkey, forming an LLC is simpler and involves fewer regulatory requirements. Shareholders’ liability is limited to their share capital, offering protection for personal assets. However, unlike joint stock companies, LLCs cannot issue stock certificates.

To comply with Turkish company laws, LLCs must have at least two key components: the company’s general meeting and managing directors. For investors considering company setup in Turkey, an LLC offers a streamlined and cost-effective way to establish a business with limited liability.

Reach out today to learn more about LLC formation and how our experts can guide you through the process of setting up a Limited Liability Company in Turkey.

Joint Stock Company (JSC) in Turkey

To establish a joint stock company in Turkey, at least one shareholder is required. Both individuals and companies can incorporate a joint stock company, with the flexibility to have foreign shareholders. The minimum capital requirement for opening a joint stock company in Turkey is 250,000 TL, which represents the total capital for the company. Unlike limited liability companies, joint stock companies can issue stock certificates, providing more flexibility in ownership and investment.

One of the key benefits of a joint stock company in Turkey is that shareholders’ liability is limited to their share capital, offering personal asset protection. To comply with Turkish regulations, joint stock companies must establish at least three key structures: general company meetings, a Board of Directors, and a supervisory board.

For investors interested in company formation in Turkey, understanding these fundamental requirements is crucial to ensure smooth business setup and compliance. Reach out to our experts for assistance in establishing your joint stock company in Turkey.

Reach out today to learn more about JS company formation and how our experts can guide you through the process of setting up a Joint-Stock Company in Turkey.

Holding Company in Turkey

A holding company is a business entity that owns shares in other companies, enabling control without engaging in manufacturing or services. It’s a strategic structure used by larger companies or multi-sector organizations to streamline capital flow and facilitate ownership transfers. Holding companies help with asset protection, tax efficiency, and investment diversification, making them ideal for companies looking to optimize their business formation and corporate structure.

If you need assistance with setting up a holding company, our experts can guide you through the process efficiently.

Branches in Turkey

When a foreign company in Turkey wishes to expand its reach without establishing a separate legal entity, setting up a branch is an efficient solution.

Opening a branch in Turkey or company formation in Turkey is a strategic step. Setting up a branch requires compliance with Turkish regulations, including submitting essential documents such as petitions, power of attorney, and notarized records, ensuring a smooth registration process. Proper branch naming must adhere to local guidelines, and additional processes like appointing managers, address changes, or capital increases demand specific resolutions and notarized documents.

Whether you are establishing a branch, exploring company establishment opportunities, or managing ongoing operations in Turkey, our team provides expert assistance.

Reach out today to learn more about branches and how our experts can guide you through the process of setting up a branch in Turkey.

Free Trade Zones in Turkey

Our firm specializes in company formation services in Turkey, including business setup in free trade zones. Free Trade Zones offer significant tax benefits and other investment advantages, making them an attractive choice for foreign investors in Turkey. At OzbekCPA, we deliver efficient and tailored solutions for entrepreneurs planning to start a business in Turkey’s free trade zones, ensuring a smooth and compliant setup process.

Reach out today to explore the opportunities of company formation in Turkey’s free trade zones and take the first step toward a successful business venture.

Liaison Offices in Turkey

Establishing a liaison office in Turkey provides foreign companies with a cost-effective entry point to explore the Turkish market without engaging in commercial activities. Approved by the Ministry of Industry and Technology, liaison offices benefit from tax exemptions, including corporate income tax, VAT, and stamp tax. These offices serve purposes such as market research, promotion, and local supervision, offering a low-risk way to expand operations.

Learn more about company formation in Turkey and how a liaison office can strategically position your business for success.

Establishing a Non-Profit Organization (Foundation, Association, NGO) in Turkey

Foreign entrepreneurs and companies can establish non-profit organizations (NGOs) in Turkey, including foundations and associations, under the Foundations Law of 2008. This law provides the framework for creating organizations dedicated to non-profit purposes, complementing Turkey’s business-friendly environment for foreign investments.

Whether you aim to establish a foundation, association, or other non-profit entity, our experts provide legal guidance to ensure compliance with Turkish regulations. Explore how company formation in Turkey can include philanthropic initiatives aligned with your goals.

Cooperative Company in Turkey

Foreign investors can establish cooperative companies in Turkey, which are member-owned enterprises created to meet the common economic, social, or cultural needs of their members. These entities operate on the principles of voluntary membership, democratic decision-making, and equitable distribution of profits or benefits among members.

Cooperative companies are governed by the Turkish Cooperative Law and relevant provisions of the Turkish Commercial Code, with sector-specific rules for different types such as agricultural, housing, transportation, and production cooperatives. Members contribute capital, share resources, and jointly manage operations, while liability is typically limited to the amount of capital subscribed.

This structure is particularly suitable for projects requiring pooled investments, collective purchasing power, or community-based production, and can be adapted to both small-scale initiatives and larger multi-sector collaborations.

How to Register a Company in Turkey?

Step 1: Choose the Business Structure

Determine the most suitable company type — such as an LLC, JSC, branch, or liaison office — by considering factors like your business activities, target market, capital requirements, tax obligations, and long-term growth plans. Choosing the right structure at the start ensures smoother operations and compliance with Turkish regulations.

Step 2: Prepare Necessary Documents

- Articles of Association – Outlining the company’s purpose, capital, and shareholders.

- Tax Identification Number (TIN) – Required for both the company and its shareholders.

- Trade Name Registration – Must be unique and approved by the Trade Registry Office.

- Notarized Passports & Signatures – For foreign shareholders and directors.

Step 3: Register with the Trade Registry Office

All companies must complete their incorporation by registering with the Trade Registry Office through the relevant Chamber of Commerce. This step finalizes the company’s legal status.

Step 4: Open a Corporate Bank Account

- Deposit the minimum capital requirement in a Turkish bank.

- Obtain proof of deposit for the company registration process.

Step 5: Tax Registration & Social Security Enrollment

- Register with the Turkish Tax Authority.

- Enroll employees in Turkey’s Social Security Institution.

Step 6: Obtain Necessary Business Licenses

- Some industries require special permits (e.g., finance, education, pharmaceuticals).

Turkey offers a strategic, cost-effective, and business-friendly environment for international entrepreneurs and investors. Whether you’re setting up an LLC, JSC, branch office, or liaison office, understanding the legal and financial framework is crucial for a smooth company formation process.

At ÖzbekCPA, we offer expert company registration services in Turkey, guiding clients through every stage of business setup in Turkey — whether they are launching a local entity or representing a foreign company in Turkey. Contact us today.

Company Formation in Niche Sectors:

- Establishing an Insurance Brokerage Company in Türkiye: Licensing and Documentation Requirements

- How to Establish a Pharmaceutical and Food Supplement Company in Türkiye: Licensing and Compliance Guide

- Process and Requirements for Opening a Private Educational Institution in Turkey

- The Process and Requirements for Opening a Private Hospital in Turkey

- Opening a Law Office in Türkiye: Required Documents and Legal Procedures

Related Articles

- Limited Company Formation Process and Requirements

- Establishment of a Joint Stock Company and Legal Requirements

- Opening a Branch in Turkey: Steps and Requirements

- Company formation in Turkey’s free trade zones

- Establishment of a Liaison Office in Turkey and Tax Benefits

- Investment Incentives in Turkey for Foreign Investors

- Foreign Branch vs. Company in Turkey

Useful Links

Frequently Asked Questions

How can I establish a company in Türkiye?

If you’re planning to establish a new company in Turkey or expand your existing business, you’ll be glad to know that the company formation process in Turkey is relatively fast and straightforward. Although you can technically complete the registration online or through a proxy, the process can be complex and requires wet signatures for final approval.

In Türkiye, you are required to work with a certified public accountant (CPA) during company formation. As Özbek CPA, we provide professional accounting and tax consultancy services to guide you through every step of this process. You are welcome to contact us directly for personalized assistance.

What are the minimum capital requirements for establishing a company in Turkey?

Effective January 1, 2024, Presidential Decision No. 7887 introduced higher capital requirements for both JSCs and LLCs:

Joint Stock Company (JSC): 250,000 TRY (previously 50,000 TRY)

Limited Liability Company (LLC): 50,000 TRY (previously 10,000 TRY)

This update significantly impacts the incorporation of a company in Turkey, making it essential for entrepreneurs to plan their capital accordingly.

For more detailed information and comparison: https://ozbekcpa.com/jsc-and-llc-differences-turkey/

Can foreigners establish a company in Turkey?

Yes, foreign investors can freely establish and fully own companies in Turkey. Both individuals and legal entities are allowed 100% ownership, as there are no restrictions on foreign participation or capital.